Submission Date:

Question:

What law, regulation, or regulatory authority governs the budget transfer policy at a school district public library? Is there any case law or authority on that?

Answer:

Quite a few laws, regulations, and regulatory authorities will impact the budget transfer policy of a school district public library. Here are the biggies:

- NY State Constitution

- NY Education Law

- NY General Municipal Law; and

- GAGAS[1]

The trick to this question is that New York's school districts, which often (but not always) act as treasurer for an affiliated school district public library, must follow not only the above-listed laws and standards, but also must follow school district-specific rules for managing budgets.

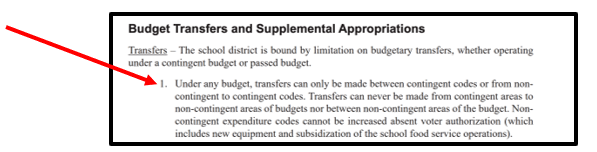

What do those school district-specific rules say about budget transfers? As can be seen in the below excerpt from the "School Districts' Accounting and Reporting Manual," a school district can only transfer funds into the budget line of a contingent fund.[2]

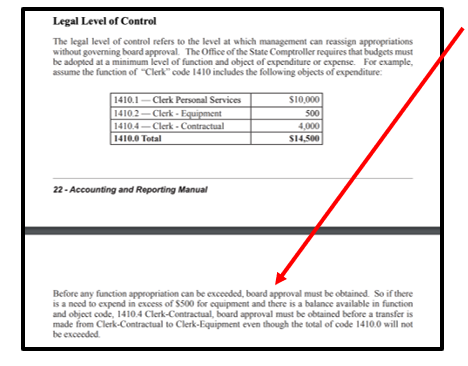

Other public entities, however, follow different rules...rules that are a bit more liberal about transfers between budgeted lines, since for inter-line transfers, "only" board approval is required...as seen below in the[3] Comptroller's "Accounting and Reporting Manual" for towns, villages, and other local government entities:[4]

SO: does a school district public library in New York have to follow the rules of its sponsoring district?

Here is what the Comptroller has to say:[5]

Public Libraries — Sponsored by counties, cities, towns, villages or school districts in most circumstances [are included in a local government's accounting] because of the existence of financial accountability as evidenced by funding of operations, approval of and responsibility for issuance and payment of debt and the ownership of real property. While this is the norm, situations do exist where the library is virtually autonomous and could be considered a special purpose government.

...

Final determination must be made at the local level after considering ... the appropriate criteria as they may apply to both governmental and non-governmental units.... [emphasis added]

In other words--while I hate to punt on this question-- IT DEPENDS. There can be no one answer; the determination must be made at the local level--and by a person professionally qualified to make the determination.

That said, as a professional, I will go out on a limb and say that every Comptroller audit of a school district public library I have ever read emphasized the difference between the library and the district they are affiliated with.[6] Further, the Comptroller, in those audits, has stated that independent board authority and oversight by the trustees must be exercised, even when the school district functions as treasurer.

For this reason, I would comfortably suggest the presumption should be that the requirement to transfer only into a contingent fund, per the excerpt first pasted above, applies solely to a school district, and not to a school district's separate public library, even if the school district is the custodian of the funds, unless the two entities are so integrated that the library operates as a "component unit"[7] of the district.

That said, for school district public libraries who must develop policy based on this distinction, the person to answer this question is the accountant finalizing your audits and financial statements, since they are the one with the professional duty here. That said, once they have determined that answer at the local level, ALL parties (the school district, the library, their accountants, and their lawyers) should be in agreement as to the reason for the decision.

Thank you for a good question, and for this reminder of why I became a lawyer, not an accountant![8]

[1] Not a gathering of meat-clad divas, but rather: "Generally Accepted Government Accounting Standards".

[2] From https://www.osc.state.ny.us/files/local-government/publications/pdf/arm_schools.pdf, page 25. If you read the excerpt deeply, you will see I am oversimplifying...and if you want to see how much I am over-simplifying, read the whole manual! School district budgeting is an art.

[3] riveting

[4] From https://www.osc.state.ny.us/files/local-government/publications/pdf/arm.pdf, page 22.

[5] From https://www.osc.state.ny.us/files/local-government/publications/pdf/arm.pdf, page 34.

[6] A good example of this emphasis on autonomy can be found in the 2014 audit of the Fairport Public Library, found at https://www.osc.state.ny.us/local-government/audits/library/2015/06/12/fairport-public-library-financial-management-2014m-354.

[7] A good flow chart on how to assess of a library is a component unit is on page 35 of this manual: https://www.osc.state.ny.us/files/local-government/publications/pdf/arm.pdf.

[8] Full disclosure: I am married to an accountant...a CPA, no less. This of course gives me no professional cred when it comes to accounting, but it does lead to some good conversation on chilly Buffalo nights (he also has an MLS, which makes him all the more alluring, of course).